One of the largest traps to homeownership isnt with sufficient bucks to get upon a property at closing. However believe you will not have the ability to get an excellent family in the event your checking account is wanting sometime lean, there are a few innovative methods be successful. Off particular loan apps in order to members of the family gift suggestions and much more, chances are perfect which you’ll have the ability to create the homeownership fantasy possible.

Considerations when you’re mortgage browse

If you’re planning for the purchasing but trying to restrict exactly how much you pay up front, keep such half dozen something at heart while you are family and you may home loan hunting:

Effective duty provider-members, pros in addition to their family relations meet the requirements for a great Virtual assistant loan, which is backed by the Department out-of Experts Facts. This allows being qualified consumers to acquire a property and no down percentage and you may nothing-to-zero closing costs.

The newest Va Make sure Fee substitute the necessity having mortgage insurance, making this an all over great way to purchase a beneficial household just in case you qualify.

2. Consider an FHA financing

New FHA loan are a popular solution which enables people to set as low as 3.5% upon a different household, and that is considering when it comes to a financial provide from loved ones or away from a qualified non-cash otherwise authorities service. Sellers also can contribute settlement costs around six% of your own transformation price of your house.

The wonderful thing about FHA finance could there be is actually reduce payment requirements and less limiting being qualified requirements, making it an effective selection for all potential family-customers. But simply know that you will end up expected to shell out good financial insurance premium using this mortgage program, no matter what the advance payment.

step three. Choose for a Homebuyer Guidelines System

Should this be the first time to shop for a property, there are a lot info available to help you navigate this type of not familiar seas. Luckily, there are even specific programs available at the local and you will national height that offer financial assistance to help you the homebuyers and in some cases, so you’re able to past home owners as well. It may be worthy of considering regional applications, county apps, Non-payouts, etcetera.

4. Don’t Overlook the USDA Mortgage

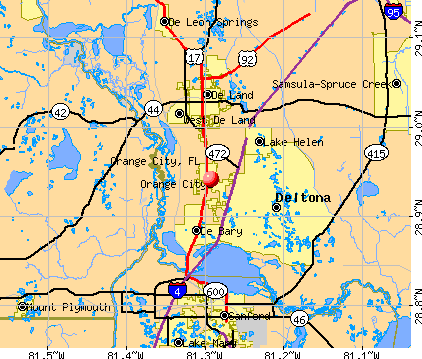

Another option offered to consumers exactly who be considered, having a no down-payment criteria, is the USDA financing program, also referred to as a rural creativity financing. Some eligible components try truth be told a bit suburban very usually do not disregard that it financing program up until you checked to see in case the assets qualifies. You will need to remember that USDA financing do require financial insurance rates additionally the loan constraints and earnings limits will vary by the area.

If you’re fortunate enough to have a close relative gift you money, they possibly can be used for the down payment so long as you cautiously follow the criteria set forth by the the bank. You will have to has actually a papers walk exhibiting whom skilled you the money, the way they gave they for your requirements incase it was given, which zero fees needs.

Extent that can be gifted is based on the kind out-of loan you select, therefore it is vital that you discuss your options together with your bank.

6. Have the Provider Spend Settlement costs

Getting your settlement costs paid down of the supplier depends on an effective amount of issues, including the current market near you. Inside a consumer’s business, where in actuality the supply of residential property is higher than consult, it may not end up being unrealistic to inquire of a seller to pay certain otherwise the closing costs.

Although not, when you look at the a beneficial seller’s field, in which the need for residential property exceeds the supply, the probability of a supplier adding towards the your own settlement costs will get become slim. It’s yes really worth inquiring, since many vendors need certainly to circulate quickly and acquire it worthwhile in order to discuss in order to make sure the marketing shuts inside the an effective punctual manner.

Make sure you remember These types of Consideration

Using one of one’s actions over is likely to make to purchase a great household inexpensive without having a lot of money readily available, although it does come with the disadvantages, and that we’re going to high light less than.

With regards to the version of mortgage you choose, you happen to be expected to pay financial insurance policies, that can impact the number of their monthly homeloan payment.

Getting a reduced amount of their currency down function you really have smaller body on game’ while could potentially deal with a higher rate of interest otherwise payment once the lenders was getting more substantial exposure.

A reduced advance payment entails it takes you expanded to build specific guarantee in your home, and it can require you to real time indeed there more than the basic 5 years to help you bring in a return even in the event it is merely something if you feel you will need to move in certain ages.

You’ll find however a few prior to purchasing property with little-to-no money off. Yet not, whenever you are in a situation where it might require you to empty your checking account so you can place a full 20% down on a house, it should be best to match less down-payment choice and you will retain some funds installment loans Oakland KY for unanticipated costs. Anyhow, make sure to talk to a mortgage lender to go over your financial options and now have any concerns responded before making a decision.

Leave a Reply