What exactly is home financing conditional approval? Does it imply I’ll be accepted getting property mortgage? Or is indeed there a chance I am turned-down in the eleventh hour?

Talking about some of the most frequently asked questions we discover from our readers, dedicated to home loan underwriting. Therefore we made a decision to answer them in one post. Let us begin by sharing exactly what a good conditional acceptance methods to your, while the a debtor.

So what does a mortgage Conditional Acceptance Indicate?

From inside the a lending perspective, a conditional acceptance happens when the mortgage underwriter is usually found into the loan application document, however, there are still no less than one problems that need resolved up until the deal can be close. Inside home loan lingo, such left issues or products are commonly referred to as criteria. And therefore the expression conditional approval.

Are you aware: Brand new underwriter is the person that studies the borrowed funds file, and all sorts of records consisted of within it, with the intention that it suits new lender’s guidance in addition to one secondary direction (of FHA, Freddie Mac computer, etcetera.). Find out more about underwriting.

You could think about the home loan underwriter since the a variety of documents detective whoever job it is to make sure everything is manageable. And it is a pretty intricate job, because there are a good amount of data and you may files regarding the the common home loan.

Whether your underwriter identifies that the mortgage is pleasing to the eye for the majority areas – but you’ll find a few things that need to be fixed – it’s called an effective conditional financial approval.

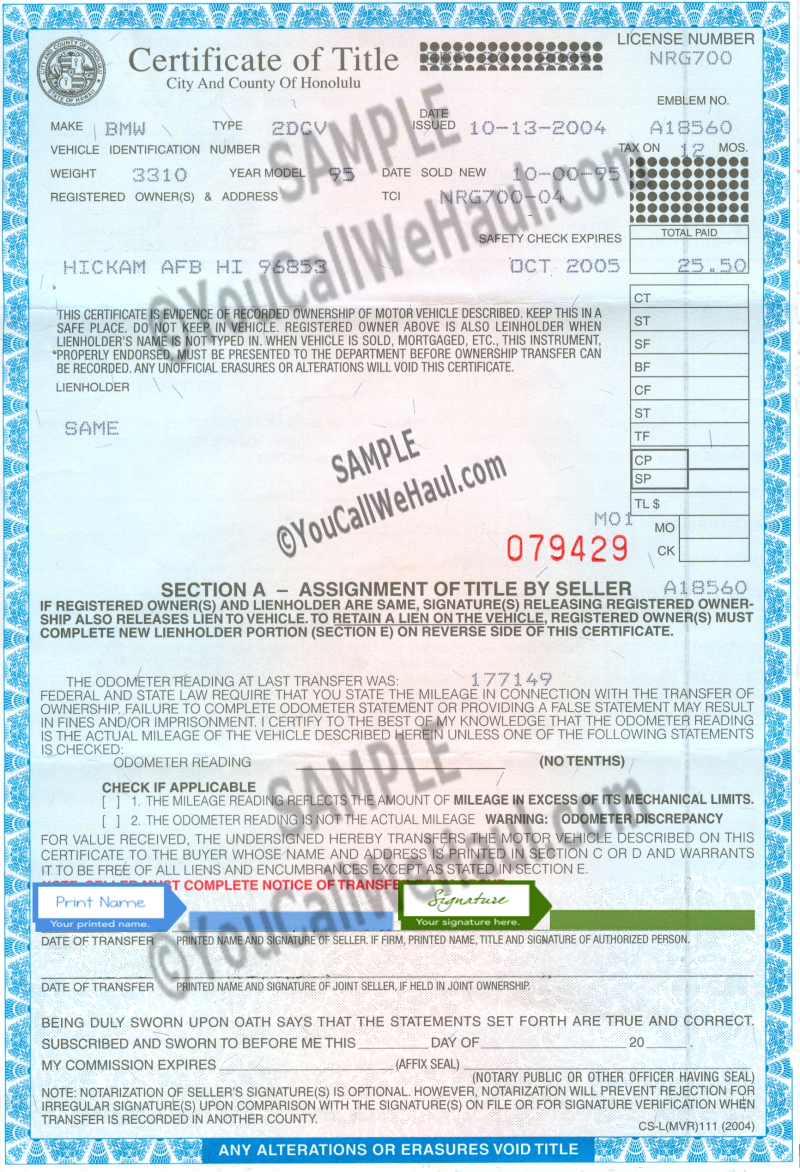

To put which to your a wide context, why don’t we glance at the easy steps that occur throughout the a good regular home loan recognition processes. No matter if it is far from in fact shown regarding the artwork less than, a conditional recognition do take place in between steps 5 and you may six. It could happens because of the underwriting process and before last recognition.

Here is a bona fide-World Example

John and you may Jane features removed a mortgage, and you may they usually have considering most of the documents their lender has requested thus far. The loan file then moves on into the underwriter, who evaluations they to own completeness and you will accuracy. He together with monitors the newest file to make sure the financing conditions were satisfied.

The new underwriter identifies that the borrowers was eligible for a loan, hence the new document consists of everything you had a need to fulfill standards. With one exception to this rule. A huge put is made into borrowers’ savings account within the past few weeks, and also the underwriter is not able to determine in which that cash showed up off.

Thus, he factors exactly what number so you can a great conditional approval on mortgage mortgage. He relates they back once again to the borrowed funds administrator otherwise processor chip and states the guy must be aware of the supply of brand new present deposit. This is exactly a condition to finally approval. This product must be solved before underwriter can be point out that the mortgage is clear to shut.

Now the ball is back from the borrowers’ courtroom. Obtained fundamentally been considering a role to do. They need to today provide a page from explanation that can go into financing document.

If the John and Jane can be fully file the source of your deposit, plus it works out that currency came from a medication resource, then your financing is acknowledged. The past conditions had been cleaned, and the partners can proceed to close into the house.

Common Conditions’ Identified by Underwriters

The fact above is one illustration of home financing conditional acceptance. In this practical analogy, the latest borrowers was required to explain and you may file a large put into their savings account.

- A duplicate of your own homeowners insurance rules

- Confirmation of borrower’s most recent work and you will/otherwise money

- Evidence of mortgage insurance coverage

- Page of cause from debtor to possess a recently available detachment

- Most other missing or unfinished documents needed for loan financing

This is simply a limited set of common home loan conditions that will have to be resolved until the finally acceptance. You might run into other needs via your underwriting procedure. Or you could cruise from procedure no most requests at all. The procedure varies from that debtor to the next.

Often My Loan Nevertheless Go through?

There are numerous level off approval into the home loan financing processes. But there is however only 1 latest recognition, which will be in the event that mortgage is largely financed (at the or just before closure). It is important to realize that some thing may go incorrect at any phase with the process, upwards towards loans Idaho Springs the finally closure.

This is simply not meant to security your, however, to get ready for the procedure – in order to understand how everything work.

Home buyers and you may home loan consumers commonly believe he is house totally free after they located good pre-acceptance away from a lender. But that’s false. An effective pre-acceptance only means you will find a likelihood you’re recognized towards financial, just like the underwriter will give you an effective thumbs-up.

Being pre-acknowledged has its own masters. It assists your narrow your own property browse and may also build suppliers more likely to accept the promote. But it is not a make certain that the deal is certainly going owing to.

There are numerous things and you can issues that could happen anywhere between pre-approval and you can capital. The conditional financial recognition is just one exemplory instance of an intermediate action which could occur.

Since a borrower, the great thing you certainly can do in case there are a great conditional acceptance is to eliminate every conditions immediately.

Communicate with your loan administrator in this stage ( this is the key part out of get in touch with). If for example the underwriter means a condition which should be resolved, the borrowed funds is basically toward keep up to that concern is resolved. Are hands-on during this period will help prevent unwanted delays and you will contain the closure on plan.

Just how long to close off Immediately after a great Conditional Approval?

Thus, just how long will it sample intimate to your an interest rate, shortly after researching good conditional recognition on the underwriter? Do you really be capable intimate promptly? Or commonly brand new conditions reduce the closing?

- The new the total amount and you may complexity of your own known condition’

- Committed it will require on how to look after brand new situation

In some cases, these issues would be solved within a day or a few. Take the letter out-of explanation circumstance mentioned before, like. You could potentially produce a page to describe a bank detachment otherwise put a similar go out you obtain the new consult. New underwriter you can expect to up coming obvious one material and you will move ahead.

In other cases, you may need to do more legwork to answer problematic. Perhaps you have in order to round-up some documents or create good pair calls. This may add time for you the brand new underwriting procedure, that may push their closure right back a few days.

Given that a borrower, a very important thing you can do was stay in touch that have your loan officer and you may manage people needs in due time. Others is out of the hands.

Leave a Reply