Just like the a moment mortgage loan only gets reduced just like the first-mortgage bank will get back all of their dominating and you can costs, the second financial risks losing area or all their dominant money in case your debtor were to stop purchasing their financial and you will the original lender if you don’t 2nd lender invokes a power away from selling. It is helpful suggestions knowing upfront the brand new process.

You could take-out a 3rd mortgage, as well as a fourth financial, which happen to be each other thought to be house guarantee money that one can borrow on your residence. So you’re able to use a 3rd home loan, you really need to have enough available and unencumbered security of your home or commercial assets.

That is made challenging from the fact that you will find less lenders who be ready to expand a 3rd mortgage so you can a homeowner.

Aligning your self on best home loan brokerage can also be significantly help improve the probability. They are also extremely helpful when you need to query one home loan associated concerns to better know how far collateral you could potentially borrow on and exactly what your options are. The best lenders also carefully explain to you the new advantages and disadvantages that include 3rd mortgages.

Yes, it is. New online privacy policy throughout the financial brokering industry, that’s influenced by the FSRA (Monetary Properties Regulatory Power out of Ontario) is very rigid when it comes to exactly how lenders and you may the loan broker takes care of sensitive customer pointers and you will investigation.

Interest levels are higher that have one minute home loan as a result of the additional chance that 2nd mortgage lender is using up

To improve the privacy safety, it is told that you do not send information that is personal by current email address. As an alternative discover safer shared Shed Package concept possibilities readily available.

Because these variety of mortgages are largely in line with the resource alone, second mortgage loans Toronto create are apt to have a great deal more competitive costs and you will highest LTV constraints. Because of the better marketability of functions situated in significant area centres, the next mortgage Toronto can occasionally extend alot more choices to the fresh new borrower.

Even although you do have adequate equity open in your possessions, you or their mortgage broker nevertheless has to be in a position to see a personal financial who will present a third mortgage

Private lenders, and you may lenders overall, consider elite appraisal businesses to have advice about deciding the modern reasonable market value out-of a home otherwise industrial property, or industrial building. The fresh professional appraisers who do work for these assessment businesses features built the reputations and you can work into taking top quality, detail by detail, and you may legitimate assessment profile to loan providers. However some loan providers in some situations you’ll go without the need having appraisals when financing next mortgage loans, be prepared to bear the brand new $3 hundred so you’re able to $500 average prices if required.

If you’d like, you can learn more about the fresh new assessment procedure in this web log post How-to: Getting the Home Appraised

The good news is all you have to would try get hold of your vendor. This can be as simple as picking up the telephone and you may placing a call to your house or industrial insurance company and you may asking them to add the 2nd home loan company onto your newest house insurance policy as the a loss payee. Here is the circumstances for everyone brand of mortgages and you will mortgage lenders once they lend with the a home or commercial assets.

You should buy the latest home loan and you will a residential property information out of a number of sources including our very own blog, all of our Fb webpage, our Twitter provide, regional news shops, the local mortgage broker or a home sales person, and much more on the internet offer.

Because recognition procedure is much simpler and you will faster, oftentimes you can buy acknowledged to have a second home loan in as little as an hour or so or 24 hours. In some situations, if everything is in order, a beneficial large financial company could probably have the loans in as low as 24 hours so you’re able to 48 hours in the event out of a simple short closure.

Other sorts of next mortgage brokers tend to be Financial Financial support Firms (MIC’s), personal mortgage loans, along with some examples, organization option mortgage brokers, and additionally often called B loan providers when you look at the Ontario. When it comes to these types of far more regulated and you may organization mortgage brokers payday loan Fort Payne, the method to apply for a moment mortgage when you look at the Toronto otherwise other places all over Ontario can also be need a minimum credit rating and some degree out-of provable earnings. Consequently, these businesses have a tendency to offer most readily useful cost and you will words, however, carry out typically wanted a whole lot more records form the fresh new borrower prior to approving and you can financial support one home mortgage. With the loan providers it could be slightly more complicated to have individuals to meet the requirements.

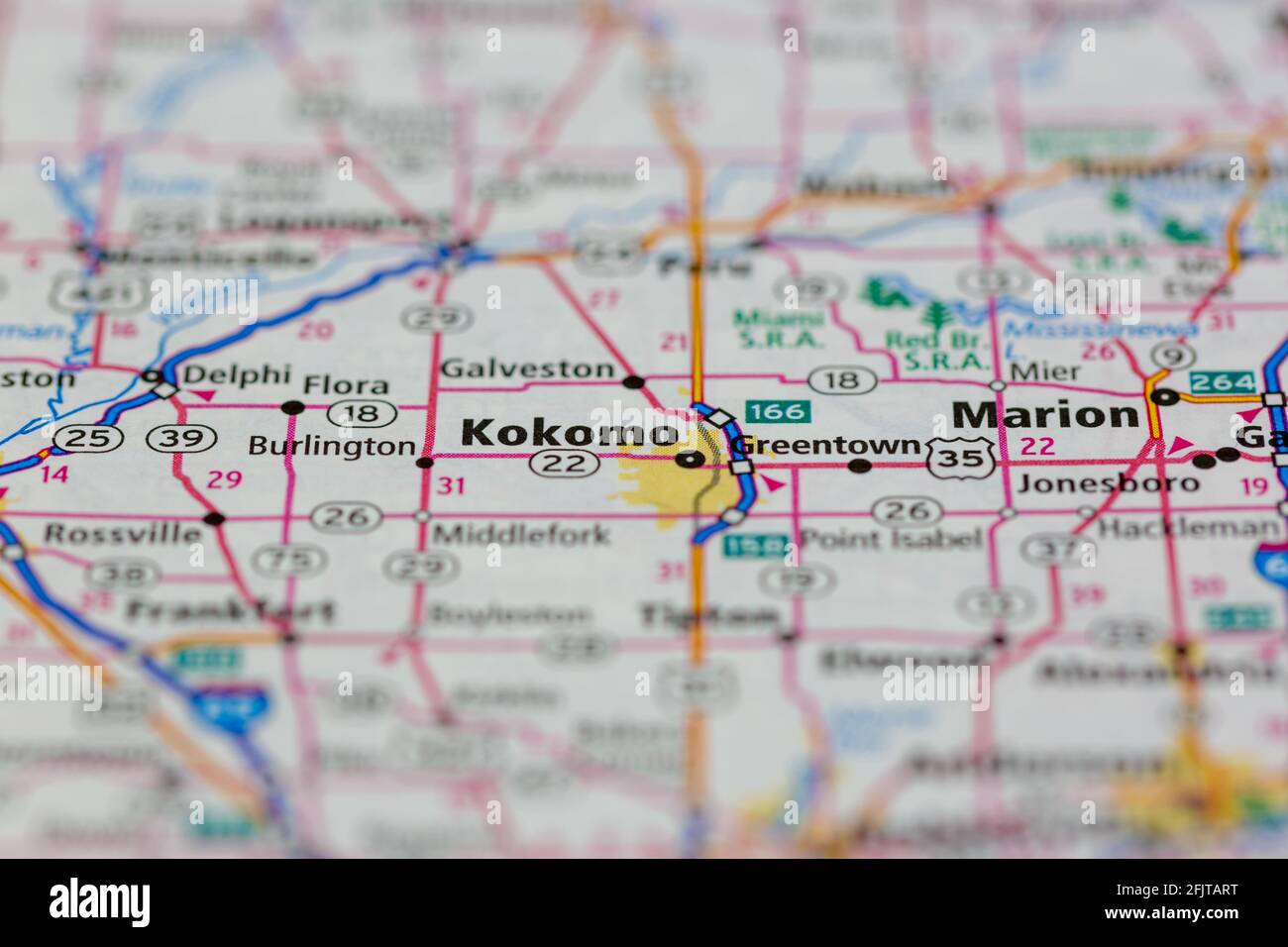

Below is a straightforward chart showing some examples of the best next financial cost and types of lenders exactly who you’ll bring him or her. You should keep in mind that an educated 2nd mortgage cost manage depend party towards the located area of the assets and its particular proximity to huge urban centers such as for example Toronto.

Throughout the graph less than, you will see and you will compare a few of the advantages and disadvantages off providing an extra financial.

Due the elevated amount of risk associated with funding a third home mortgage, the option of lenders is more limited. Most of the time, just private private buyers do agree to provide toward a third home loan into the third updates. Due to this fact the procedure to apply will be convenient, due to the fact private private lenders have a tendency to care most about the real property alone, because they primarily jobs into the principals of asset-depending financing and you may using. Such applications generally speaking do not place far, or no, focus on the fresh new borrower’s credit score, and then have hardly any focus on the funds earned and you can proclaimed by the debtor, or perhaps the history of this new borrower’s careers.

Remember that these are rarer things while accepted, they are available with significantly large cost and you will costs than just if for example the LTV including the next financial stays less than 75% otherwise 80%. Neighborhood possessions markets can assist determine the modern value of your home. LTV becomes a whole lot more important when loan providers determine the interest rates and you will charges to help you fees towards the next mortgages.

Leave a Reply